In the ever-evolving landscape of Environmental, Social, and Governance (ESG) reporting within real estate management, there has been a pivotal theme: the essential collaboration between real estate owners and occupiers,…

In the continuing exploration of the intersection between Environmental, Social, and Governance (ESG) reporting and the evolving landscape of real estate management, our series on ESG innovation dives deeper into…

In the rapidly evolving landscape of real estate and lease management, the convergence of data standards and environmental, social, and governance (ESG) considerations marks a pivotal era of transformation. We…

Managing a complex lease portfolio across real estate and equipment in global business operations presents significant challenges. Today, we dive into an insightful transformation journey spearheaded by the Director of…

In the ever-changing world of lease accounting, staying informed and compliant with the latest standards and regulations is crucial for all organizations. Zena Thomas, a distinguished Product Owner at Visual…

In the complex world of business, understanding the difference between lease accounting and lease administration is crucial. Although they might seem similar, they each have unique and important roles when…

It’s clear that the journey towards and beyond compliance with lease accounting standards (ASC 842, IFRS 16, & GASB 87) is fraught with challenges and opportunities. The strategic importance of…

Businesses have encountered unique opportunities to transform their lease portfolios from mere contractual obligations into dynamic, strategic assets. This evolution, spurred by effective management and the integration of cutting-edge technology,…

As businesses navigate the complexities of the post-pandemic landscape, the question of whether to lease or buy equipment is more pertinent than ever. The global health crisis, followed by economic…

In the complex accounting landscape, fund accounting is a specialized area that demands meticulous attention, especially for non-profits, universities, hospitals, and governmental entities. Fund accounting is essential for these organizations,…

In this blog post, we will provide a comprehensive breakdown of GASB 87 and explain what you need to know. Revisiting the Introduction of GASB 87 The lease accounting standard,…

Best Practices for Negotiating Ideal Lease Terms We’re diving into the intricacies of GASB 96, a significant standard that government entities need to adopt, especially following the implementation of GASB…

We’re diving into the intricacies of GASB 96, a significant standard that government entities need to adopt, especially following the implementation of GASB 87. The Essence of GASB 96 GASB…

In our latest blog post, we delve into the findings of our Visual Lease Data Institute (VLDI) research that sheds light on the evolving terrain of lease accounting. About the…

We’re delving into the complex world of lease accounting and its tax implications, particularly in the wake of the COVID-19 pandemic. We’ll share valuable insights into how businesses, especially retailers,…

Adopting the ASC 842 lease accounting standard has been one of the most impactful changes in accounting practices, particularly for private companies gearing up for compliance. Drawing from the experience…

In today’s fast-paced business environment, lease accounting has become an increasingly complex task for organizations. Manual processes and outdated tools like Excel not only pose a high risk of errors…

The management letter from auditors, typically received by CFOs after the annual audit, highlights key financial findings and suggests improvements for internal controls. It also informs about new accounting standards…

Is Excel good for lease accounting? 1. Lease terms constantly change, and it’s hard to keep up 2. Lease accounting calculations are complex and time consuming 3. Excel spreadsheets are…

3 Reasons to Stop Relying on Excel Spreadsheets 1. Leases are constantly changing 2. Excel can lead to non-compliance with accounting standards 3. The Office of Finance has evolved 3…

What is completeness assertion in lease accounting? Auditing completeness under ASC 842 What is audited under completeness assertion? How to ensure accurate completeness assertions Getting started with lease compliance Inaccurate…

Using ASC 842 Excel Templates How to Create Customized ASC 842 Excel Templates Best Practices for Data Entry and Formula Setup Best Practices for Document Organization Common Challenges with ASC…

Table of Contents What is a lessee? What is a lessor? Who is the lessor and lessee in a contract? Benefits for a Lessor vs Lessee How to approach accounting…

Table of Contents How to Calculate the Present Value of Lease Payments in Excel Step 1: Organize Data Step 2: Use the PV Function Step 3: Repeat as Needed Cons…

Lease accounting and management have evolved into intricate processes, posing fresh challenges for financial leaders. From grappling with an accountant shortage to seeking enhanced lease flexibility during economic uncertainty and…

Lease management is more complicated than ever before. Tenants and landlords are navigating a lot of hurdles, including organizations’ need for greater flexibility – according to the Visual Lease Data…

California has taken a significant step toward addressing climate change by enacting the ground-breaking California Climate Accountability Package. This legislation not only sets the stage for comprehensive reporting of carbon…

In the world of commercial real estate leasing, Common Area Maintenance (CAM) charges play a pivotal role, impacting both landlords and tenants. CAM rent, often referred to as CAM fees,…

As a landlord, one of the most critical aspects of your rental property business is the lease agreement. A well-crafted lease agreement not only protects your interests but also provides…

Much like their for-profit counterparts, nonprofits must also follow specific financial reporting standards, including Accounting Standards Codification (ASC) 842. This blog post will delve into the essential aspects of ASC…

Leasing arrangements are a common aspect of business operations, allowing companies to secure assets and facilities without the commitment of ownership. However, within the realm of lease accounting, there’s a…

When it comes to managing leases and financial obligations, understanding how to calculate a lease amortization schedule is crucial. This schedule not only helps you keep track of payment timing…

In the realm of business decisions, the choice between leasing and buying assets has significant financial implications. To help evaluate these options, the concept of “Net Advantage to Leasing” comes…

When it comes to real estate and leasing agreements, terms can sometimes get a bit muddled. One such pair of terms that often find themselves used interchangeably are “lessee” and…

Leasing is a common practice in business, allowing companies to acquire assets without a hefty upfront cost. However, situations arise where a lessee wants to transition from leasing to outright…

As a company navigating the intricacies of lease accounting, you’re no stranger to the importance of maintaining accuracy and compliance. Part of this process involves undergoing lease audits, a task…

The realm of commercial leases encompasses a complex lifecycle that spans far beyond the mere agreement itself. While it’s a subject that often invites surface-level discussions, grasping the full scope…

Navigating the world of lease accounting can sometimes feel like deciphering a complex code. The terms, regulations, and methodologies can leave even the savviest professionals scratching their heads. One such…

Navigating the Transition: Understanding Challenges Faced by Newly Public Companies and Strategies for Success In the dynamic landscape of public offerings, the surge in initial public offerings (IPOs) during 2020…

Visual Lease, LLC (hereinafter “VL,” “we,” “our,” and “us”) appreciates being given an opportunity to comment on the Exposure Drafts published by the International Sustainability Standards Board (hereinafter the “ISSB”)…

Visual Lease, LLC (hereinafter “VL,” “we,” “our,” and “us”) appreciates being given an opportunity to comment on the Exposure Drafts published by the International Sustainability Standards Board (hereinafter the “ISSB”)…

In today’s fast-paced business landscape, small and mid-sized businesses (SMBs) face numerous challenges in managing their financial operations efficiently. As a business owner, you may be wondering “Do I need…

In the world of leasing agreements, there can be some confusion when it comes to the terminology used by attorneys and accountants. One such term is the “lease commencement date.”…

Contract management plays a crucial role in modern business operations, ensuring effective collaboration, risk mitigation, and regulatory compliance. With the growing importance of environmental, social, and governance (ESG) considerations, contract…

VL experts break down the recently announced sustainability reporting standards from the International Sustainability Standards Board (ISSB) The first-ever set of standards recently unveiled by the International Sustainability Standards Board…

Lease incentives play a crucial role in lease agreements, representing payments made by the lessor either to the lessee or on behalf of the lessee. These incentives are an integral…

As businesses increasingly recognize the importance of environmental, social, and governance (ESG) factors, the concept of ESG accounting has gained prominence. This blog post aims to shed light on ESG…

In recent times, the importance of sustainability in financial reporting has gained significant traction. To address this growing need, the newly formed International Sustainability Standards Board (ISSB) has released two…

In today’s world, where environmental sustainability is a top priority, understanding carbon accounting has become crucial for businesses. But what exactly is carbon accounting? This article dives deep into the…

When it comes to commercial leases, there are various types and terms that can be confusing for both lessors and lessees. Among these terms are “triple net leases,” “pass-through leases,”…

In the realm of financial management, companies are faced with critical decisions regarding capital budgeting. These decisions involve allocating funds to various investment opportunities. Additionally, companies often seek the assurance…

Lease purchase options provide companies with the opportunity to convert a lease into a fixed asset. These options allow lessees to exercise their right to purchase the leased asset during…

In the realm of financial accounting, fixed asset accounting holds significant importance for companies. It involves the meticulous tracking and management of owned assets, ensuring their existence, location, and allocation…

What is Prepaid Rent? Prepaid rent refers to lease payments made in advance for a future period. It represents an asset on the company’s balance sheet, as the prepayment can…

Leasing an asset with the intention to eventually purchase it is a common practice among businesses. Whether it’s an optional purchase at the end of the lease or a bargain…

Update: On June 26, 2023, The International Sustainability Standards Board (ISSB) announced their first two global sustainability-related disclosure standards in response to widespread demand for better transparency, consistency and reliability…

Table of contents: What is a finance lease? What is an operating lease? Key Characteristics of an Operating Lease Finance Leases vs. Operating Leases Understanding finance leases and operating leases…

Table of Contents What is Off-Balance Sheet Financing? ASC 842 Impact on Reporting Leases Importance of On-Balance Sheet Reporting Legal Regulations: The SEC’s Strict Stance Off-balance sheet financing refers to…

From Compliance to Optimization: Harnessing Lease Controls for Business Success Lease accounting standards implemented over the last few years (ASC 842, IFRS 16, GASB 87) require all organizations, whether they…

Fixed Asset Accounting: Managing Assets and Leasehold Improvements In the realm of financial accounting, fixed asset accounting holds significant importance for companies. It involves the meticulous tracking and management of…

ESG and the Future of Real Estate: How Sustainability is Changing the Industry The real estate industry is undergoing a significant transformation as sustainability becomes a top priority for investors…

Related Party Leases under ASC 842 Recently, the Financial Accounting Standards Board (FASB) introduced new rules and clarifications regarding the treatment of related party leases under ASC 842. Although these…

GAAP vs. Tax Accounting: Navigating the Complexities of Financial Reporting With the introduction of ASC 842, some private companies are struggling with the requirement to record the vast majority of…

The ongoing effects of the pandemic, evolving workplace trends and unique economic circumstances have driven businesses to reconsider how and why they enter into new leases. But how exactly are…

This is part II of our Mastering Lease Accounting Compliance series. If you missed part I, you can read it here. Adopting a lease accounting standard can have a significant…

This is part I of our Mastering Lease Accounting Compliance series. If you’re looking for part II, you can read it here. Lease accounting standards such as ASC842 and IFRS16…

With more and more organizations focusing on ESG initiatives, we’ll use this blog to demystify what ESG is, why organizations choose to focus efforts on ESG related initiatives, and how…

In response to lease accounting standards, your business may have already set in place certain lease accounting systems and technology to achieve compliance. But did you know these solutions can…

Today, many organizations lack control over their leases, which increases the risk of making costly errors, such as overpaying or missing a date for termination or renewal. (90% of senior…

Accounting teams are often left scrambling to find lease information needed to wrap up the year and prepare for their audit. As businesses approach year-end, how can they ensure an…

What is depreciation in accounting? The 4 depreciation methods in accounting Can you change depreciation methods from year to year? Straight line method Declining balance method Units of production depreciation…

When considering the financial impact of your lease portfolio, there are five questions to keep in mind. Detailed below, answering these questions can help you better understand: Your readiness for…

Do your lease footnote disclosures comply with the new lease accounting standards? The footnotes of your financial statements must include certain information from your lease contracts. And with the newly…

By: Joe Fitzgerald, Senior Vice President of Lease Market Strategy Spreadsheet applications are easily the most important and universal accounting tools used today—so much so that you’d never guess the…

What is lease management? What are lease management tasks? Who is responsible for lease administration? How can you optimize your lease management strategy? Why is lease management important? Lease Management…

On-demand webinar summary Lease accounting is an incredibly time-consuming, complex endeavor that involves a lot of initial preparation, cross-departmental collaboration and ongoing maintenance. So, how can businesses ensure their lease…

On-demand webinar summary Do you know if you are overpaying for your leases? Unfortunately, many businesses are, but are not aware of it until after they begin tracking their lease…

The new lease accounting standards have radically changed the way private and public companies record leases on the balance sheet. Naturally, this had a direct impact on lessees, lessors and…

On-demand webinar summary According to a recent VLDI survey, 35% of private companies were less than halfway through or had not yet started the process of gathering information needed to…

What is IFRS 16? What changed under IFRS 16? What is considered a lease under IFRS 16? Exceptions to the IFRS 16 Lease Accounting Standard IFRS 16 Impact on Financial…

The Financial Accounting Standards Board (FASB) recently issued an update to ASC 842 that addresses complexities associated with discount rate calculations. In this blog, we share how this update affects private…

What is lease capitalization? Lease capitalization is the act of recording Right-of-Use Assets and related lease obligations on a company’s balance sheet, as required for the lease accounting standard ASC…

Lease accounting compliance is not just a one-and-done disclosure. It is a new approach to accounting that includes an ongoing, cross-departmental effort – and a much higher level of scrutiny….

Under the FASB ASC 842 standard for lease accounting, organizations face significant changes including both new disclosures and specific requirements for how to report those disclosures. For instance, in the…

The upcoming FASB accounting changes are not only a challenge for corporate accounting teams, but also for the commercial real estate group. To get you up to speed, here’s an…

Are you beginning to plan for your transition to ASC 842? Learn about the biggest ASC 842 balance sheet changes, the important implications of the changes, and get access…

Table of Contents What is Capital Lease Accounting? What is a Capital Lease? Main Differences Between a Capital Lease vs. Operating Lease What are the 4 Criteria for a Capital…

There is power within your lease portfolio. Over the last year, public and private businesses have taken a closer look at their leases – and experienced the downstream benefits of…

This article originally appeared here in Forbes. As a result of Covid-19 and the changing landscape related to leases, private companies have received more time to prepare for and adopt…

This article originally appeared here in Forbes. In 2020, many companies were forced to make tough decisions regarding their leased commercial spaces. From office closures to consolidations and deferrals, many…

Lease accounting is a massive, cross-functional effort. It involves various stakeholders and systems that impact (and are impacted by) leases. It is not just an accounting problem – and goes…

Lease accounting (ASC 842, IFRS 16 or GASB 87) is not your average one-and-done disclosure. This whole new approach to accounting requires you to account for lease changes throughout the year with a higher level of scrutiny. A…

Among the many different calculations used in lease accounting, the incremental borrowing rate may be one of the most misunderstood. The incremental borrowing rate (IBR) is the interest rate a lessee would…

Table of Contents What is a lease term? Lease lengths defined under ASC 842 Long-term leases under ASC 842 Short-term leases under ASC 842 Month-to-month leases under ASC 842 ASC…

What are rent concessions? Rent concessions are discounts, incentives, or other benefits provided by landlords to tenants. Landlords sometimes offer rent concessions to entice tenants to sign a new…

Changes in accounting standards have made lease accounting more difficult. Adopting IFRS 16 lease accounting, for example, has made compliance cumbersome as it involves adjusting to new policies, systems and…

Beginning in 2006, there was a concerted effort by the two accounting standard bodies (FASB and IASB) to synchronize their respective standards on leasing to assure consistency and uniformity. The…

Table of Contents What is a roll-forward report? The importance of roll-forward reports Roll-Forward Reports: Meeting Lease Accounting Standards The advantages of roll-forward reports Creating Comprehensive Roll-Forward Reports Why…

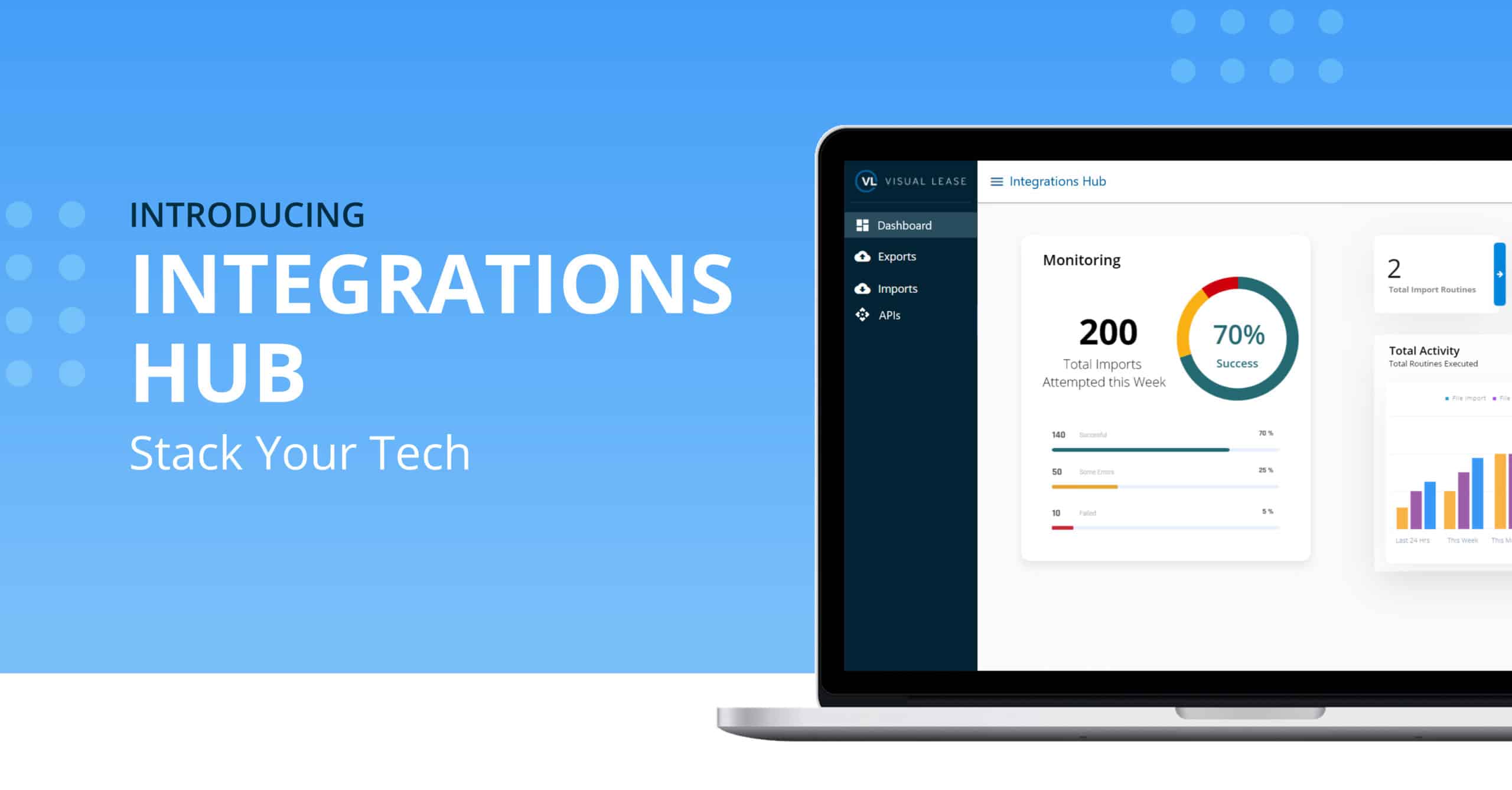

Visual Lease launches the integrations hub, providing powerful, flexible & open access to lease data

Lease portfolios often account for a massive portion of a company’s risk exposure and overhead. And yet, most businesses lack visibility into their leases to understand their obligations and options – and…

What is an embedded lease? Simply put, embedded leases are components within contracts that entail the use of a particular asset, where the user has control over that asset. You…

How to Abstract, Manage and Report on Lease Data When FASB issued its update to the lease accounting standard, the main goal was to increase the transparency and comparability of financial reporting. …

Hundreds of private organizations have begun their journey towards lease accounting compliance. Although, many of them underestimate the amount of effort involved with preparation. In particular, assembling a team…

Buying technology for cross-functional teams can be notoriously nightmarish, especially as you dive in and realize you need to expand your scope, shorten your timelines, or overhaul your processes along…

How to Save Money and Improve ROI with Lease Accounting Technology Leases are complex documents that can be challenging to interpret. Critically important details are often buried deep within a…

Lease Accounting Compliance: Lessons from Public Companies Although private companies still have some time to adopt the new lease accounting standards, public companies have already had to meet their compliance…

Many private companies breathed a sigh of relief when the deadline for transitioning to FASB’s newest lease accounting standard was once again extended — this time, until 2022. But make…

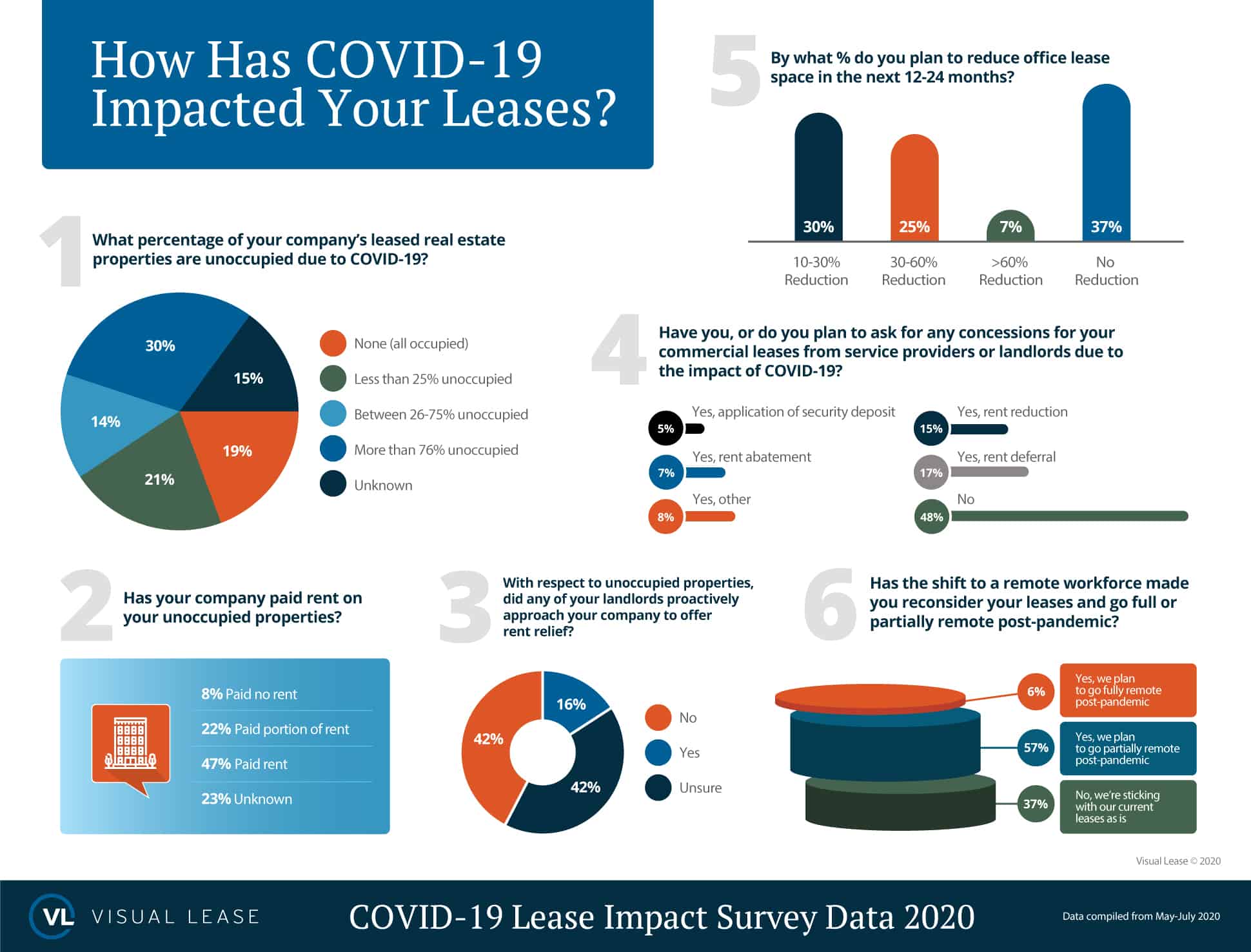

We recently surveyed hundreds of companies, including 700 Visual Lease customers (see Fig. 2), about the impact COVID-19 has had on their corporate real estate leases. As seen in the…

Recently, we have talked a lot about ways that companies can understand their lease obligations and reduce costs in light of COVID-19. What many businesses have discovered during this time…

Across industries, sectors and organizations of different sizes, the COVID-19 outbreak has touched virtually every business in some way. Between stay-at-home orders, emergency closures, and supply chain disruptions, companies are…

With all the business closures and cutbacks due to the COVID-19 pandemic, a lot of companies are worried about not only managing their lease expenses now, but also accounting for…

Deciphering financial and contractual obligations of a lease can be a challenge. And that is especially true during an unprecedented event, such as the COVID-19 pandemic. All you really want…

The COVID-19 pandemic has impacted every company in some way. With “social distancing” and all the emergency regulations that are in place, many offices and nonessential businesses are shut down…

In an act of relief for companies during the coronavirus pandemic, the Financial Accounting Standards Board (FASB) recently voted to propose a one-year deferral of major accounting standards, including ASC…

Visual Lease is committed to the health and safety of our employees and the community, as well as to providing your organization with the highest levels of uninterrupted service and…

Visual Lease, the leader in lease accounting and management software, today announced it has been selected as a 2020 “Best Place to Work in New Jersey”. The annual NJBiz “Best…

Leasing vs buying is not an easy decision to make regardless of the asset involved. While there are lease vs buy analysis Excel sheets, choosing one over the other is…

With all the new lease accounting rules you have to contend with — whether you follow ASC 842, IFRS 16, or GASB 87 — the prospect of generating lease accounting…

As of the beginning of this year, GASB 87 lease changes have gone into effect. These new lease accounting rules have a substantial impact on government entities and public institutions…

There have been several major changes in the way businesses address service contracts in recent years given the new standards and updates on the existing standards. For one, the new…

If you have signed an operating lease for space, built leasehold improvements, and determined that you are legally required to take out the leasehold improvement when the lease expires, then…

For many businesses and their accounting departments, the recent move to the new ASC 606 revenue recognition rules from the Federal Accounting Standards Board (FASB) was eye opening. The process…

The Financial Accounting Standards Board (FASB) and International Accounting Standards Board (IASB) are not blind to the tedious task facing firms once the new standards take effect. Hence, the creation…

The start of the new year means planning for what you need to accomplish in 2020. For accounting teams in private companies, there’s a big task on your plate this…

How often do you have this experience when evaluating enterprise software? The vendor gives a demonstration of an amazing solution, walking you through complex tools that do exactly what you…

In attempt to become compliant with the new lease accounting standards, particularly ASC 842 and IFRS 16, there are many intricate details that accountants often have questions about. Today we’ll…

Looking to select the best software for the new lease accounting standards? Due to the tight compliance timelines and complex lease information, this decision can be a difficult one to conquer….

If you’ve been reading up on preparing for the transition to FASB’s new ASC 842 accounting standard, you may have heard that lease data collection is complex and time consuming….

As the standard for lease accounting software, Visual Lease provides the tools you need to achieve compliance. We make it easy to track, report, and manage your lease finances within…

This week, U.S. accounting rulemakers voted in support of giving private companies an extra year to comply with the recently-adopted lease accounting rules. Companies now would have until 2021 to…

The stakes are high when it comes to choosing a lease accounting platform, because it directly affects the accuracy of your company’s financial reporting. Just about every firm working to…

The challenges of lease accounting data collection for distributed firms Getting ready for compliance with the new lease accounting standards (FASB ASC 842 and IFRS 16) is a complex and…

For private companies faced with adopting ASC 842 and/ or IFRS 16 this year, there are many complex lease accounting decisions to make. These decisions impact not only your compliance…

If you’re a private firm just beginning to prepare for compliance with the new lease accounting standards (FASB ASC 842 and IFRS 16), consider yourself extremely fortunate. While you certainly…

For private companies just beginning to think about adopting the new lease accounting standards, it may seem like you’ve got plenty of time. The lease accounting compliance deadline for a…

When ASC 842 and IFRS 16 were first announced, there was quite a bit of uncertainty about how the accounting would work for variable rent leases. Large public companies found…

Can your lease accounting software find lease payment mistakes? Were you under the impression that lease accounting software could only perform accounting calculations and add information to your balance sheet?…

If you work for a public company, you are probably breathing a sigh of relief after achieving lease accounting compliance with the new standards just in time for the deadline…

Journal entries for the new lease accounting standards: are you getting the intelligence you need? As the deadline for complying with FASB lease accounting changes draws closer, financial leaders are…

For public companies who must comply with FASB ASC 842 and/or IFRS 16 within a few short months, how to get ready FAST is the critical question. The fact is,…

For most corporate attorneys, FASB ASC 842 compliance is an accounting exercise that is only vaguely on their radar (if at all). Here is why that is as a major…

As a lease accounting solution provider, we talk to finance leaders every day who are facing the deadline for FASB ASC 842 and/or IFRS 16 compliance. Not surprisingly, we hear similar…

As the deadline approaches for compliance with the new lease accounting standards, many companies are scrambling to choose a lease accounting tool. Just about everyone we speak to has the…

Preparing for the FASB lease accounting changes is time-consuming, and there are many tasks you’ll need to complete before the deadline so you’re ready to comply. Getting software for the…

Back in 2016 when FASB released their new lease accounting standard changes, the implementation deadline seemed far away and there were more immediate accounting issues to deal with (such as…

Lease modification accounting is a subject that isn’t getting as much attention as it should… yet. That’s going to change the closer we get closer to the deadline for IFRS…

For every organization that’s purchasing lease accounting tools to comply with the new FASB and IFRS standards (which is just about everyone), data security is a major concern.

As you prepare to implement the new lease accounting standards, you’re going to have questions and you’re going to need lease accounting guidance. Certainly you’ll turn to your accounting advisory…

Why measure and optimize equipment lease performance? Most large, global organizations have some form of management and oversight in place for their real estate leases. After all, those leases represent…

Achieve fast compliance and long-term value with Grant Thornton and Visual Lease’s joint lease accounting solution With the enactment of the new IFRS 16 & ASC 842 (FASB) lease accounting…

With FASB compliance less than a year away, Visual Lease is doing all we can to smooth the transition — including delivering a new lease accounting update designed to make…

FASB lease accounting is changing the game not only for companies with leases, but also for the real estate brokers who help them to manage their property leases. Now, in…

For corporate real estate decision-makers, will the new lease accounting standards make an already challenging job even more difficult? You already have many factors to consider when choosing locations, negotiating…

We know you’ve got questions about the IFRS and FASB changes related to the new lease accounting standards. Even if you’ve carefully reviewed FASB ASC 842 and IFRS 16, it’s…

Good news for companies facing FASB compliance in 2019 There’s good news on the FASB compliance front, which is not quite official yet but should be finalized any day now….

Organizational Challenges & the New Lease Accounting Standards There are many organizational models that are used to manage corporate real estate. Companies adopt primarily two models: centralized and decentralized. In…

Lease accounting software has become a necessary expense for most organizations due to the new IFRS and FASB lease accounting standards. However, choosing wisely can save more money in operating…

Lease accounting changes: the onus and the opportunity It’s no secret: the lease accounting changes required by FASB ASC 842 and IFRS 16 have put a significant burden on companies,…

Because of the new FASB and IFRS lease accounting changes, leases are an increasingly visible part of your organization’s financial reporting. Leases are now being carefully scrutinized by everyone, including…

As organizations are preparing to adopt the new FASB and IFRS lease accounting standards, virtually all must choose new technology to facilitate the process. And many are under the assumption…

In recent weeks, we’ve been participating in some insightful events with corporate Controllers, CFOs, CAOs, global accounting firms, and other members of the financial leadership community, including the Controller Summit…

As your organization begins collecting the necessary data to comply with the new FASB lease accounting rules, it won’t take long before you realize that you won’t get everything from…

Think you have all the data you need for ASC 842/IFRS 16 compliance? Think again. Extracting data for ASC 842 transition or IFRS 16 compliance is more than a numbers…

With deadlines looming, organizations are racing to get the lease data necessary to comply with updated FASB ASC 842 and IASB 16 rules — especially the public companies that have…

As organizations worldwide prepare to transition to the new lease accounting standards, FASB ASC 842 & IASB IFRS 16, accounting teams are anticipating a heavy workload to prepare for the…

Changes are coming — is your organization ready? The Financial Accounting Standards Board (FASB) is gearing up to align U.S. standards with global accounting standards, increasing transparency in financial reporting…

The new FASB and IASB leasing standards go in effect in 2019. And one of the provisions requires a retrospective accounting of lease costs back to 2017. Recently PwC and…

How do you organize your CRE department? The structure of the CRE organization should directly correspond to key processes such as leasing, construction, design and facilities management. Organizational structure varies by the size of the real estate portfolio, the type of industry, the level of outsourcing and the geographic dispersion of the real estate portfolio.

In the latest issue of the LEADER, the official publication of CoreNet, two of my former colleagues, Mike Joroff and Frank Becker, co-authored an article entitled, “Exploit Change and Uncertainty to Drive Corporate Value.” Becker and Joroff collaborated with me on several projects, including Office 88 (Becker-1983) and the Agile Workplace (Joroff- 2003) The authors make the case that many of the assumptions about the office, technology, and work need to be updated and revised to reflect the new trends visible in the global workplace.

In 1972, when I first took on a real estate management job at Xerox in Chicago, one of my most important tools was my Rolodex. For the younger reader of this blog, I should explain that the Rolodex was a simple filing of business cards or small index cards, arranged in alphabetical order, and containing names, phone numbers, and mailing addresses of service firms, colleagues, and other contacts. I would use the Rolodex at least 2-3 times a day to look up service people who I might need in an assignment or project, or check in with contacts who might help as a reference.

In an earlier blog post I addressed the subject of outsourcing corporate real estate services. One of the key services that is central to the real estate process is the need for design services, typically interior design services. Maintaining a design team internally is expensive and unnecessary. For some organizations having a design professional as a member of the CRE staff is advisable for the purposes of supervising the design contract firm and evaluating designs in various stages of development.

From time to time clients raise the question of the difference between corporate real estate and facilities management. In essence, they’re asking why we have two different professional designations since they both seem to have the same responsibilities. But the two professions have distinct differences and responsibilities. Here we explore these differences and attempt to bring clarity to the issue.

There’s always a dispute within the organization aboutthe issue of chargebacks, particularly facility occupancy costs. Department heads typically question the need for charging back occupancy costs, since they don ‘t feel they have any direct control over these overhead costs. But occupancy costs are directly linked to staffing, so it’s logical to burden a department with its share of occupancy costs relative to staffing levels. The argument for chargebacks centers on the need for reinforcing cost containment, as well as maintaining a level of fairness in the organization.

In March of this year, Sodexo released a study of the corporate real estate profession, focusing on its image and value as a viable career path. Having practiced in the profession for over twenty-five years, I experienced first hand the challenges and rewards of corporate real estate as a junior manager, a senior executive and as a broker and consultant . For many years, corporate real estate didn’t enjoy the cache or prestige of other corporate functions such as marketing, finance, and even Information Technology. But this is changing with the advent of new leasing standards and workplace strategies. So it was with this personal back ground I took a special interest in the Sodexo survey and report.

In June of this year, Corenet Global published a report entitled, “The Future of Corporate Real Estate.” The report covered several major trends which would influence the corporate real estate function. Such trends as sustainability, advanced information technology, globalization, the “gig economy”, urban development, workplace changes, etc. would all have a major impact of the future of corporate real estate.

Security and safety is now high in the minds of CRE managers, because of the eruption of violent terrorist attacks worldwide. It seems a day doesn’t go by when some violent outbreak takes the lives of multiple victims. In many companies the CRE executive is responsible for physical security and thus, must develop a plan for insuring the safety of people and assets in the workplace. Typically the IT department has responsibility for information security, but it’s wise for the CRE executive to coordinate with the CIO on security. So what are the key priorities that need to be addressed in a workplace security plan?

In the last several Blog posts, I’ve explored the various steps in becoming a CRE executive. Today I want to address the question of CRE organization. There is no one organizational model that is ideal. But there are various structures thatfit the needs of most business entities.

In our continuing series about how to become a CRE executive, the conversation would be incomplete without a brief review of the IT basics relating to CRE management.

Entering a career in Corporate Real Estate can take many paths. During my career I met countless CRE executives with myriad backgrounds. Some moved from real estate services such as brokerage or consulting. Others came into the profession as architects or engineers. A popular avenue is facility management, since the disciplines of property and maintenance management are a natural stepping stone to real estate management.

Performance management in corporate real estate has matured rapidly over the last ten years due primarily to the evolution of sophisticated real estate management systems. With the advent of integrated workplace management systems(IWMS), and now cloud based point systems (like Visual Lease), CRE organizations have a wide range of options in the type and utility of portfolio management systems.

Space (square footage) is the universal unit in corporate real estate management. It defines the basis for rental, allocation of costs to different occupant groups, is the primary factor in developing space requirements for different utilizations such as offices, work stations, conference rooms, storage spaces, etc. Most companies develop a set of space standards as a means to design office layouts, allocate space to various functions, and use to forecast space demand over time.

Back in November of last year I cited a study by CBRE that seemed to debunk several myths about the Millennial generation and the office environment. The essence of the study was that while Millenials had certain preferences and attitudes about the workplace, in general there was little difference between the generations about their desire for workplace flexibility, preferences for urban settings, more collaboration, and more autonomy. However, in a recent article about Millenials in the March 15 issue of Fortune magazine, the theme of the article is about how to attract and retain the Millennial generation.

In my last Blog posting I covered the subject of co-working; an office concept which entails using office space on a shared basis. Unlike executive suite operations such as Regus serviced offices; co-working is less formal, collaborative and aimed at the millennial generation. Co-working is growing rapidly in most major urban areas, particularly in central business districts. The outlook for growth is stunning, with nearly 2000 locations anticipated within five years. One of the most successful operators, Wework, now has a market cap of over $5 billion, with no slowing in growth expected.

But co-working is not without its drawbacks.

The primary driver of this growth is the rise of the contingent worker, which represents about one third of the US workforce according to government estimates. With the advent of mobile technology and cloud computing, millennials, those between the ages of 20-35, seek non-traditional work environments as well as a sense of community. Co-working meets these needs by offering informal and edgy workplaces, and a spectrum of services that might include WiFi, marketing training, social events, and even conferences aimed at the young, independent entrepreneurs.

For some large companies, the charter of CRE has expanded to include physical security, sustainability, and now even the charter may include company wellness programs. In an open online survey conducted by CoreNet Global, a strong majority of respondents – 80 percent — said that corporate wellness initiatives represent a “significant trend,” while only 20 percent said that they were a “passing fad.”

Earlier last week I attended a dinner in San Francisco of a group of corporate real estate executives. During the evening I had a chance to speak with several of the attendees, and queried what were the major issues being discussed by the group at their 2 day meeting. A number of topics came up including the subject of Corporate Wellness, Sustainability, and Strategy.

A major question I am asked on occasion is what is the best way to organize the corporatereal estate function. There are several fundamental principles that should be considered to answer this question.

During my tenure as head of real estate I always began the new year with a few resolutions that would become goals for the year ahead. These were typically above and beyond department objectives for the year and represented personal goals for some kind of improvement. Here are a few that I recall..

With the New Year it’s a good time to take stock of the corporate real estate domain and consider the challenges facing the managerial profession responsible for the corporation’s real estate assets and services in the year ahead. Here are five major challenges if dealt with effectively will determine in part the success of corporate real estate in 2016.

In my last Blog entry I wrote that IOT would be a megatrend that would revolutionize building operations by imbedding machine addressable technology in every aspect of the built environment. IOT is not new. In fact the technology has been around since the late 1990s. Gartner estimates that there will be nearly 26 billion devices on the Internet of Things by 2020.

Price Waterhouse Coopers recently published a report, “The Future of Work, a Journey to 2022,” in which the consulting firm developed three scenarios of how the future of work may evolve over the next 7 years. Mike reviews them here.

October, 2015 is the month and year when Marty McFly traveled from July 1985 to the future in the famous Delorean time machine. Thus, it’s a good time to review past predictions of the changing workplace, and to rate their accuracy. Predictions of the future almost always miss the mark. Here are a few of my favorite classic misses:*

In a earlier white paper, The Lease Accounting Tsunami; Are You Prepared to Weather the Storm?, I wrote that users should evaluate the effects of the new FASB/IASB on a company’sdebt structure, debt to equity, and other factors that would be affected by the new standard, assuming lease liabilities would be considered as debt. In point of fact, the FASB explicitly decided that Type B lease liabilities should not be considered as “debt.” However, the IASB which treats all leases as Type A leases or capital leases, does consider these liabilities as “debt-like liabilities.” (Their exact words) As one of my accounting friends advised “The accounting for Type A leases requires IASB companies to record interest expense, and segregates payments on the lease liability into operations and financing outflows per the cashflow statement, which is consistent with debt.”

Thus, US companies will experience less impact from the new standard, particularly as it relates to debt covenants, debt to equity metrics, and capital structures. But US companies with significant international lease portfolios subject to the IASB standard, will see their debt levels increase.

Having split my career between facilities management and IT management, I gained an appreciation of how these two professional disciplines have many similarities, but distinct differences which createpolitical difficulties in many organizations.

Virtually the entire infrastructure of the enterprise combines traditional facilities assets: buildings, land, furnishings, and lease contracts and IT assets: servers, storage, networks, mainframes, and applications. In the last half century these distinct asset classes have become ever more intertwined, interdependent, and fused to create work platforms.

So what are the major components of the corporate real estate strategic plan?

At the time I was the Corporate Real Estate Director of a major multinational corporation with a headquarters in New York City. It was the mid 1990s, and the real estate market in midtown Manhattan was a bit soft. Senior management wanted to move out of New York to an owned (and relatively vacant) office building in suburban Connecticut.

We are frequently asked why we need a new FASB lease standard.. here are our thoughts…

What are some guiding principles for selecting and investing in software functionality in support of your facilities and real estate operations?

Perhaps one of the most daunting and complex responsibilities of the corporate real estate executive is the management of lease escalation costs. These costs which represent expense pass- thrus from the landlord to the tenant can represent nearly half or more of the cost of tenant occupancy.

Many companies today use tenant representatives to handle various leasing actions such as leasehold relocations, renewals, expansions, and extensions. Tenant representatives are commercial brokers who typically operate exclusively as tenant advocates, while collecting commissions from building owners. This may seem like a conflict of interest, but the industry has self-regulating practices to avoid most abusive behavior.

Advances in technology and changes in user behavior are driving significant transformation in Integrated Workplace Management Systems (IWMS) software architecture and delivery..

As a Gartner analyst some years ago, I focused on the real estate/ facilities management software space. I had spent nearly thirty years in corporate real estate, and was perhaps the only analyst at Gartner who had a broad and varied background in corporate real estate. I wrote one of my first research notes, in April of 2003 on the corporate real estate and facilities management space when I identified the key components of what I later named IWMS.. a lot has changed since then.